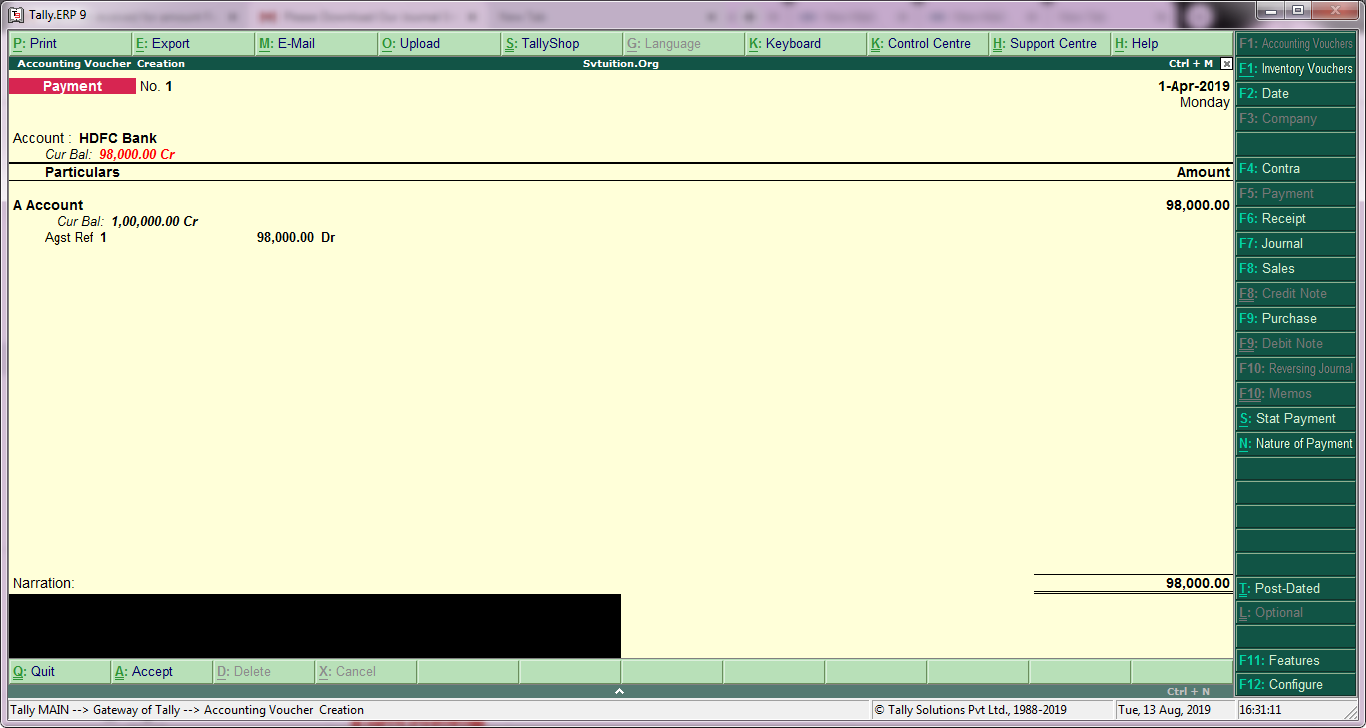

All ERP solutions will have their own special type of vouchers to record Sales, purchase payment receipt and journal separately.īut when you purely look at the concept of a journal entry it is something different. The same rule applies to any ERP Solution. Want to Learn TDL and why you should learn TDL?īut in an ERP Software like Tally.ERP 9, for a systematic maintenance of records, there is always different types of vouchers are being created. a Sales or a purchases bank or what every transaction in business is a kind of a journal entry where one account is debited and another account is debited. Purely thinking from the accounting viewpoint then almost any type of voucher e.g. Again a payment or a receipt entry also can be posted in a journal voucher and that is why the question of journal entry comes, most people feels confusion here. Which account needs to be debit and which account needs to be credited is a matter of Accounting principles. Typically a journal entry refers to a financial transaction where one account is being debited and another account is being credited. What are ledgers involved in a journal entry.

Once you go through the pass you can will understand how the journal entry quite well.

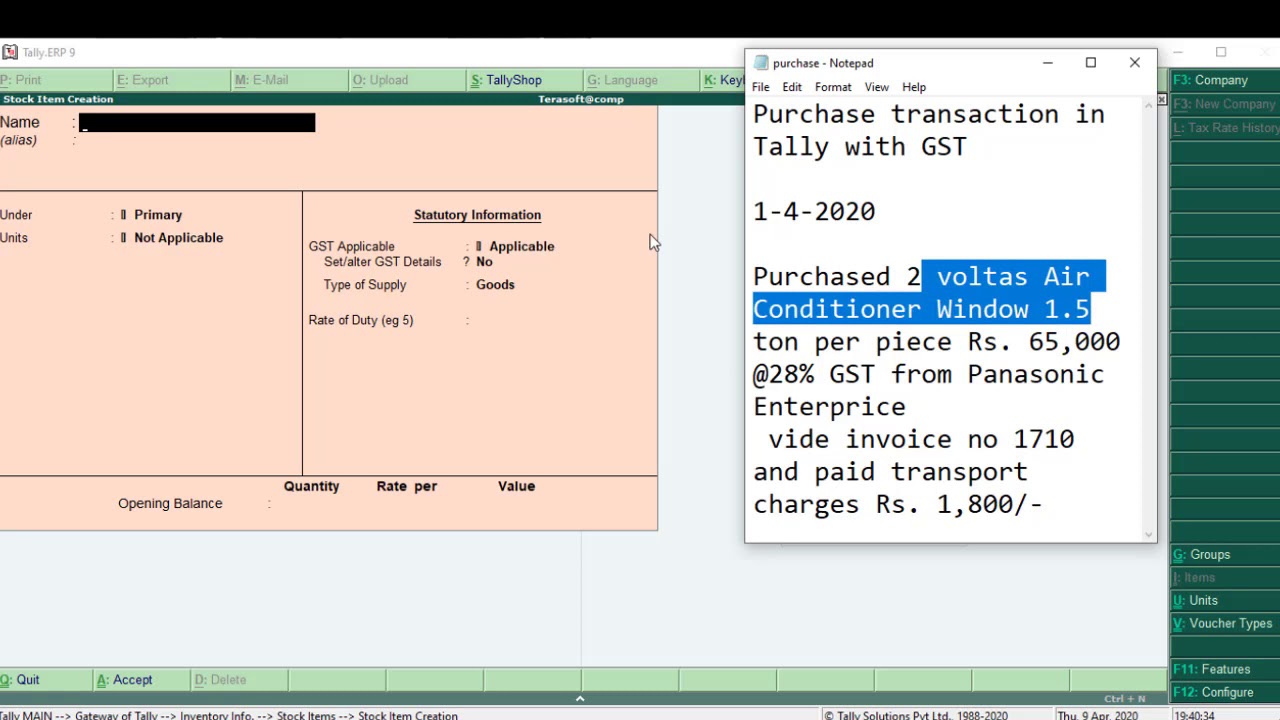

That is because of lack of knowledge of accounting rules and lack of a guidance from a professional and experienced mentorīefore I teach you how to pass a journal entry in Tally.ERP 9, It should be better to know the steps which are needed to understand. It is a type of accounting voucher in Tally, you can record all transactions related to sales (Local and interstate sales) either in invoice mode or voucher mode, based on the nature of the transaction and you can print the invoice and provide the invoice copy to the your customer by using the sales accounting voucher (F8) in Tally.ERP9.Ĭreating of Sales Ledgers for GST in Tally.ERP9Ĭreate sales ledgers percentage wise like, interstate exempt sales and nil rated sales for the easy understanding purpose.Journal entry in Tally.ERP 9 is one of the simplest things which one can do without any serious efforts if the person knows a little bit of basic rules of accounting Though most of the people feeling unnecessary confusion in Journal Entry itself.

0 kommentar(er)

0 kommentar(er)